It also supports 27 major currencies, thus enabling you to serve customers in some major global markets out of India. CCAvenue also allows a Multilingual payment page in 18 major Indian and international languages. Again, some providers might have better pricing, features or services (or all three) to support the payment methodology that your customers like.

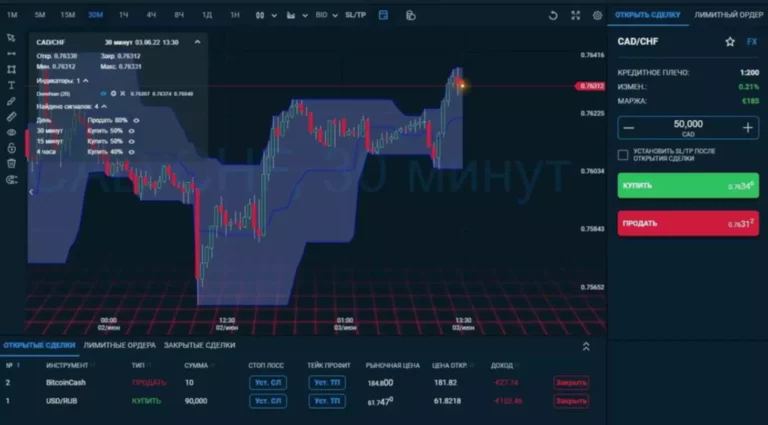

“A notable trend we’ve observed is scammers exploiting Chinese payment gateways due to their relative ease of use and limited regulatory scrutiny. According to the cybersecurity company CloudSEK, these scammers are evading actions by law enforcement agencies by using Chinese payment gateways and Indian money mules. Next-Gen Payment Gateway is a fully integrated plug and play online payment platform serving industries with multiple customer touchpoints.

Some examples include the customer’s identity and their bank details. In some cases, especially for large amounts, the customer’s spending patterns can also be considered. The payment gateway acts as the intermediary between the merchant’s website or app and the acquirer and issuer banks. A drawback to Square is that they charge a premium for manually entered transactions. You’ll pay 2.75% for swiped transactions and 3.5% plus 15 cents for manually entered credit card transactions. Today’s near-field communication (NFC) technology makes contactless payment possible.

Payment gateways, which are interfaces used to collect consumer payment information, are an important feature of the digital economy. By allowing customers to safely and securely share their credit card information, these systems reduce some of the barriers to online commerce. DirecPay is one of the largest payment gateway solutions service providers in India.

Cashfree’s payment gateway pricing is just 1.90% per transaction [Lowest TDR charges in India]. Moreover, they have the fastest settlement cycle of 24 hours to 48 hours. Offer your customers subscription plans with automated recurring transactions on various payment modes, through a platform that’s built for automation.

One of the most popular payment gateway for forex brokerss worldwide, PayPal’s redirect payment gateway is a great option. Cashfree Payments enables 3,00,000+ growing businesses in India and across the globe to collect payments, make payouts, manage international payments, and more. Cashfree Payments is backed by SBI, Y Combinator, and Apis partners and was incubated by PayPal. Cashfree Payments has two no-code solutions for entities that want to accept payments without a website or application – Payment Links and Payment Forms. With our ready-to-use integration kits, you will be able to integrate the best payment gateway in no time.

Its main purpose is to secure payment processing from user authentication to fund settlement. A payment gateway collects customer card information and encrypts it for later processing. A payment processor uses that information to charge the customers’ bank or credit card provider. For cash payments, you don’t need a payment gateway or a virtual terminal.

You can accept payments online from Indian as well as international customers using Paytm All In One Payment Gateway. It does not require additional APIs for international payments and real-time currency conversion. This option is ideal for larger businesses that want to control the entire checkout experience via their own systems and servers.

That’s why it makes sense to offer something like PayPal, Venmo, or Apple Pay, too. Support as many options as possible, so customers can make purchases with whatever payment method they want. With it, merchants can accept payments from customers using Touch ID and Face ID. It takes a lot of time and effort to build your own payment gateway. However, if you’re low on budget and want to save time, consider simple and cheaper alternatives like partnering with a payment service provider or using a white-label service. If the processor focuses on card-present payments, a payment gateway enables merchants to accept payments where a card doesn’t have to be present.

Square is a payment gateway provider, credit card processing company, and ecommerce platform well known for the card readers that attach to your smartphone. They are great for businesses that need to accept online payments and in-person payments. A payment gateway is technology merchants use to accept debit and card payments from customers. It refers to the physical card readers you see in brick-and-mortar stores. It also refers to the online portals used to collect online payments. PCI-DSS is a globally recognised security standard and protocol, and businesses with a PCI-DSS certificate have the ability to securely store card information.

Delight customers with best success rates on mobile and UPI, and access payment gateway advanced features. White label payment gateways let businesses add their own branding to their payment processing service while using third-party payment gateway providers. Helcim’s payment gateway offers a flexible billing structure and an easy-to-use interface. With a Helcim merchant account, you can accept customer payments in-person and online. Another reputable online payment gateway is Stripe, which facilitates credit and debit card payments for all business types. Both components work together to ensure smooth, secure, and efficient electronic financial transactions.

The modus operandi of Chinese scammers include creating fake instant loan apps, promoting illegal apps, demanding personal information and processing fee payments, and then disappearing after payment. Competitive software companies are looking back at 2023 and identifying market and tech trends gaining momentum for 2024 https://www.xcritical.in/ to help them plan. Using those insights, ISVs can develop new solution features that users demand and increase the value that their software provides. However, if your software integrates with a payments solution, you need to consider payment trends as well as what users are looking for from your core solution.

- ECOM stands for electronic commerce and refers to every transaction done via eCommerce platforms.

- We are proud to partner with some of India’s biggest businesses, and are able to support them seamlessly without hitting our transaction limit.

- Depending on the type of payment gateway, your website’s platform, and any additional features or customization your business needs, the payment gateway integration process will vary.

- PayPal claims to have processed 4 billion payments (including 1 billion mobile) in 2014.

- Consequently, many merchants opt to incorporate both a payment gateway and a virtual terminal in their operations.

This ease extends to financial services too, with applications for business loans, credit cards and debit cards. The streamlining of daily operations is another plus, offering insights about shoppers, risk management and operational efficiency. You forfeit some control over the customer experience by using a third-party service, but you also don’t have to worry about handling security yourself.

Recent Comments